In Türkiye, tax regulations are constantly updated and shaped according to changing needs. In this context, there has been a significant change with the regulation made on July 15, 2023 regarding the VAT and corporate tax exemptions applied to the sale or transfer of immovable properties held by corporations for at least 2 years. We would like to inform you about the details and effects of this new regulation.

1- VAT Exemption on the Sale of Real Estate in the Assets of Companies has been abolished as of 15.7.2023

The VAT exemption application for the sale or transfer of immovable properties held in the assets of corporations for at least 2 years has been terminated as of 15.7.2023. Before 15.7.2023, the pre-amendment provisions will be applied for the immovables in the assets of the institutions before 15.7.2023.

Accordingly, the application of VAT exemption on the sale or transfer of immovables acquired after 15.07.2023 and to be kept in the assets of the institutions for at least 2 years has been terminated.

Before 15.7.2023, VAT exemption will continue to be applied for immovables acquired before 15.7.2023 and kept in the assets of the institutions. With the Provisional Article 43 added to the VAT Law, it is stated that the pre-amendment provision of Article 17/4-r of the VAT Law will be applied for the immovables in the assets of the institutions before 15.07.2023.

2- Corporate Tax Exemption for the Sale of Real Estate in the Assets of Companies has been abolished as of 15.7.2023

With the regulation made

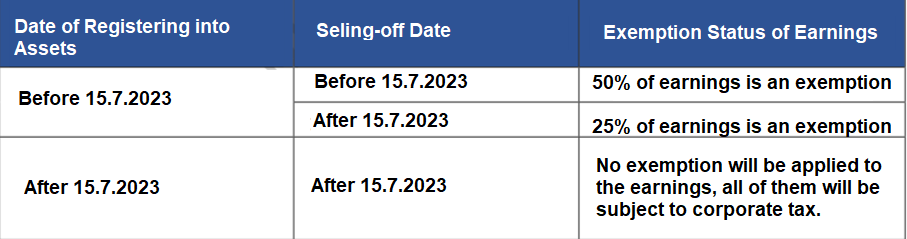

2.1- The regulation exempting 50% of the income derived from the sale or transfer of immovable properties that have been in the assets of the corporation for at least two years for companies whose main business is not real estate trading and leasing has been terminated. The regulation will be valid for the immovable properties entered into assets after 15.7.2023.

2.2- Instead of completely abolishing the exemption for immovable properties in the assets of corporations before 15.7.2023, which is the effective date of the Law, the exemption rate has been reduced to 25% of the gain. (It was applied as 75% until 31.12.2017 and 50% as of 1.1.2018)

The regulation entered into force as of 15.7.2023.

_____

The impact of these new regulations on the business community is unquestionably significant. VAT and corporate tax exemptions were not already in place for corporations and investors involved in the purchase, sale and lease of real estate. The exemptions were rights granted to companies whose main business was not real estate trading. After the regulation, companies will have to make their tax planning according to these new conditions. In addition, the timing of the sale of held immovables will also be a factor to be taken into consideration.

In conclusion, the new regulations on VAT exemption for the sale or transfer of immovable property by companies are a reflection of changes in tax policies. In order to manage these changes effectively, it is important for businesses and investors to seek expert advice. Keeping abreast of future tax regulations and strategizing accordingly will be a critical step towards achieving financially successful outcomes.

Ali KARAKUŞ

CPA & Independent Auditor

Karen Audit & Consulting

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.