April 11, 2023

S&P Global Sector PMI™

Tourism & Recreation leads growth in March

- Key Findings

Activity growth most widespread for a year

Tourism & Recreation activity up at sharpest pace in ten months

Only Chemicals and Forestry & Paper Products see output decrease

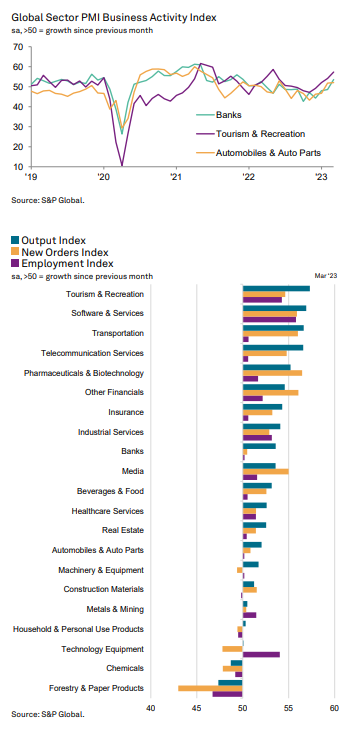

The latest S&P Global Sector PMI™ data signalled that the Tourism & Recreation sector led a pick-up in global business activity at the end of the first quarter of the year, with almost

all monitored categories in expansion territory. The only exceptions were Forestry & Paper Products and Chemicals as Basic Materials sectors remained under pressure.

The expansion in Tourism & Recreation activity was sharp and the fastest since May last year amid a third successive rise in new orders. In turn, companies took on extra staff at a faster pace.

At 19, the number of sectors seeing output increase in March was the highest for a year. Following closely behind Tourism & Recreation were Software & Services, Transportation and Telecommunications Services which all posted marked increases in activity.

There were some signs of recovery in the Financials category, with Real Estate and Banks posting increases in activity for the first time in 12 and nine months respectively. The weakness with regards to production and demand in the Chemicals and Forestry & Paper Products sectors was reflected in pricing trends during March. These two categories were the only ones monitored to see reductions in input costs and output prices. Meanwhile, the sharpest inflation across both measures was seen in the fast growing Tourism & Recreation category where selling prices increased

at the sharpest pace since June last year.

Employment growth was the most widespread for nine months, with renewed job creation seen in the Automobiles & Auto Parts, Beverages & Food, Media, Banks, Real Estate, Transportation and Telecommunications Services categories. Alongside the two struggling Basic Materials sectors, only Household & Personal Use Products and Construction Materials recorded declines in staffing levels. In both cases, however, rates of job shedding were only marginal.

Source: S&P Global Sector PMI Report

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.