February 3, 2023

Corporate debt rose by more than $12 trillion in advanced and emerging economies during the pandemic as companies borrowed to strengthen their balance sheets and survive the economic shock. But steep rises in interest rates and more expensive debt service are stretching firms’ finances, even as global debt declines as a share of gross domestic product.

This build-up of risk in the corporate sector and a doubling of funding costs for even the safest issuers could pose serious problems for many economies and their financial systems. A new machine-learning model developed by IMF staff predicts the probability of corporate distress spilling over into systemic economic risk, based on lessons from previous crises in 55 advanced and emerging economies since 1995. We identify around 50 indicators—from firms’ debt ratios to credit expansion and overvalued assets—that might have power to predict future crises and then train the model.

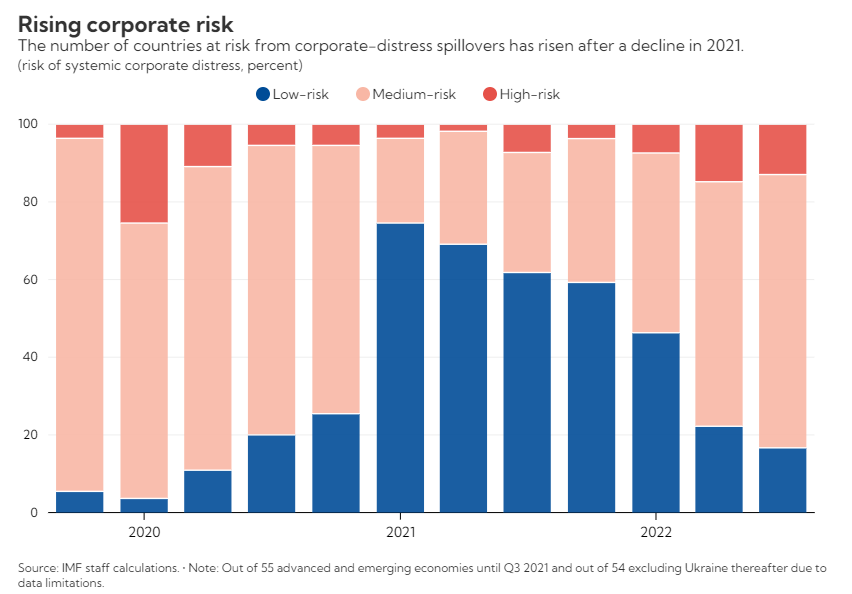

As the Chart of the Week shows, the number of countries at medium or high risk of spillovers from corporate debt defaults and other forms of company distress increased sharply last year due to tighter global financial conditions. This reversed a decline in risk seen in 2021 when policymakers raced to support stricken companies with cash and debt forbearance.

Thirty-eight of the economies tracked by our early-warning model are at medium risk and seven economies, mostly from Europe and Asia, are at high risk of systemic corporate distress. More countries are at high risk than before the pandemic. Moreover, the proportion of large economies in this category has increased, with high-risk countries accounting for 21 percent of world GDP in the third quarter of 2022, up from just 1 percent at the end of 2019. Only nine economies are seen as low risk.

After a sharp rise in 2020-21, international debt issuance by non-financial companies fell by $136 billion in the year to June 2022 as firms found it costlier to access finance, figures from the Bank for International Settlements show.

Further tightening of global financial conditions would increase the risks faced by both advanced and emerging economies. Spillovers from corporate distress could include slower economic growth, rising unemployment, pressure on vulnerable households, volatile asset prices and a spike in non-performing loans at financial institutions. And the situation could be made worse by other factors, such as dollar appreciation, which would add to pressures faced by many emerging economies.

Time to act

What can governments do? First, countries where companies are failing or likely to should build effective insolvency systems and facilitate market-led restructuring of heavily indebted firms to contain systemic risks, as discussed in a previous IMF blog. Countries’ crisis preparedness and insolvency frameworks matter greatly and could be strengthened particularly in emerging economies.

Second, countries should continue to use macro and microprudential policies that target high-risk sectors and borrowers. To limit the possibility of spillovers to the financial sector, countries should also use lender-side macroprudential policies for banks and other financial institutions. For example, by improving transparency of lenders’ assets and liabilities, refraining from further lending to firms that cannot pay existing debts, strengthening capital buffers, and conducting comprehensive stress tests.

Source: IMF Blog – Burcu Hacibedel, Ritong Qu

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.