February 7, 2023

T&C industry evolution during the third quarter of 2022 and short-term prospects

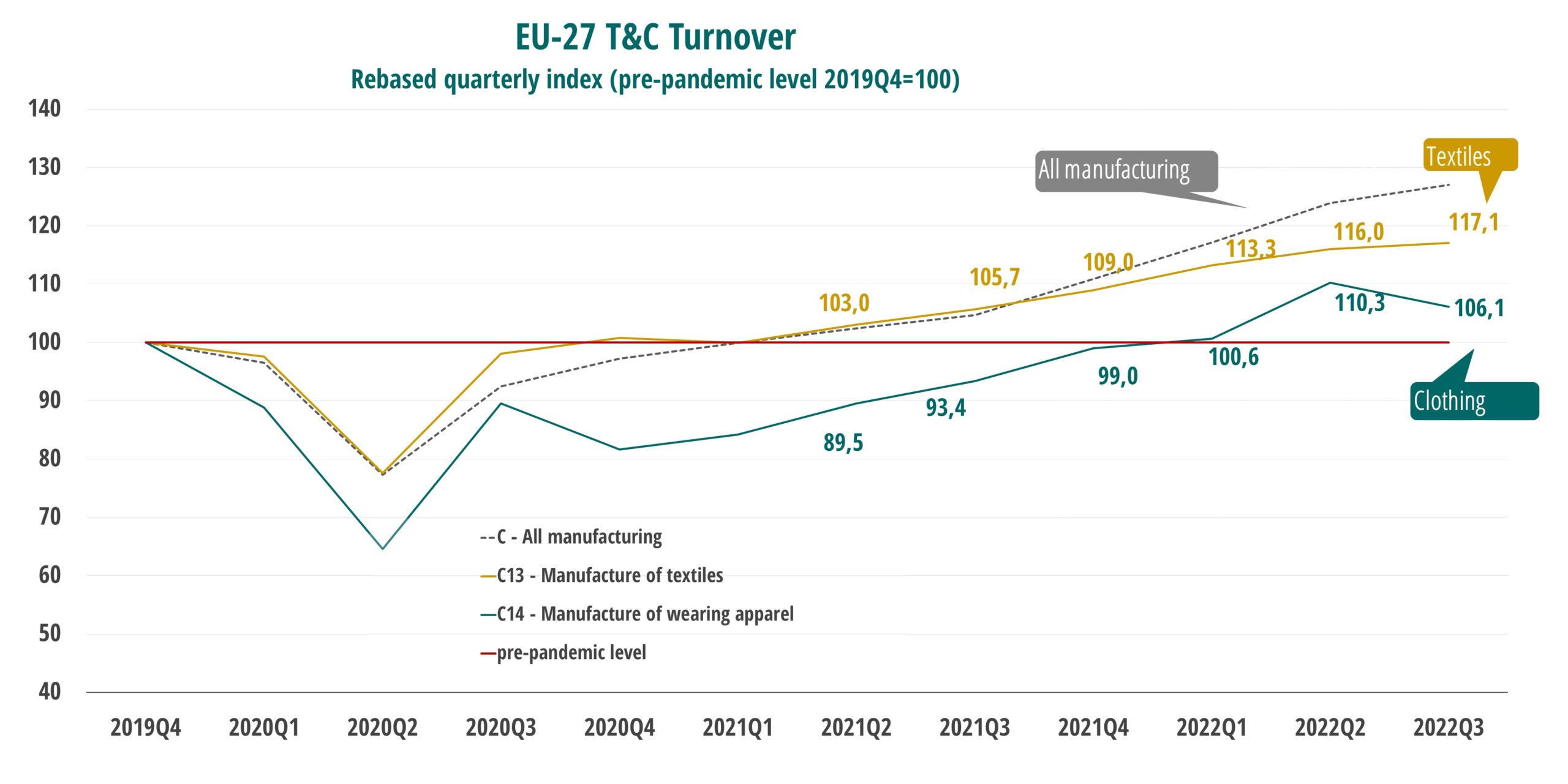

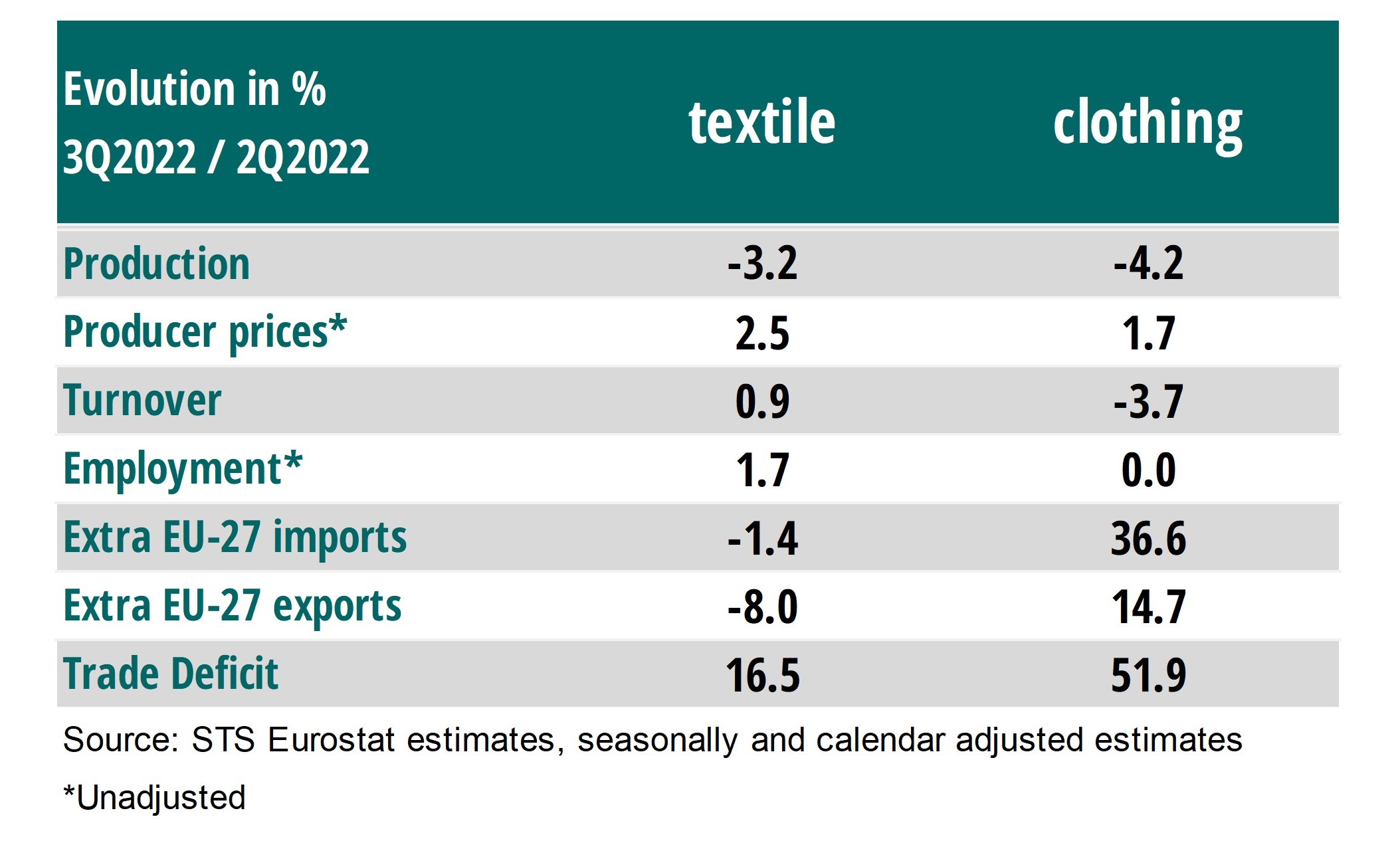

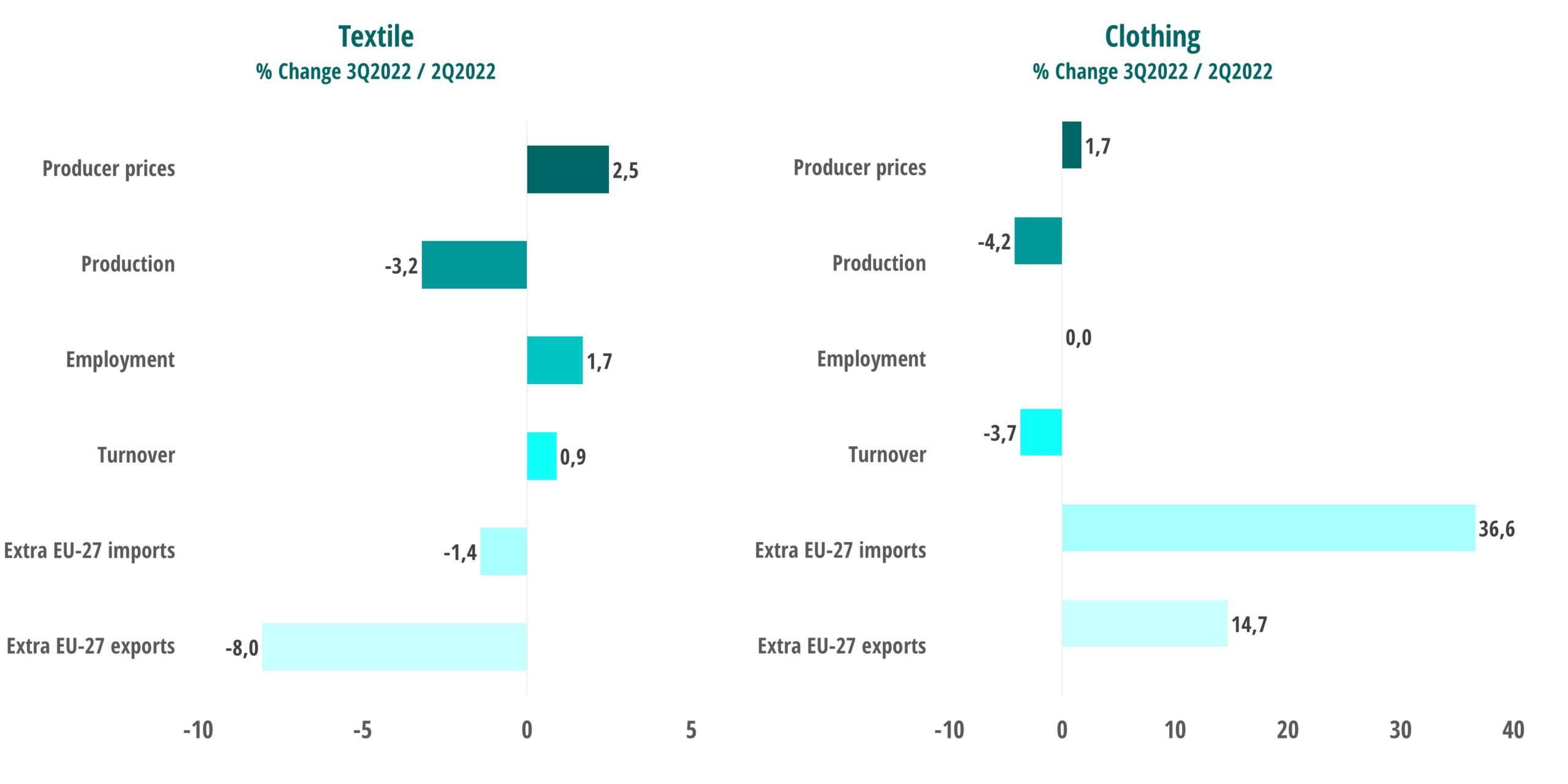

Economic performances in the textile & clothing industry showed a mixed picture in the 3rd quarter, as companies are facing tougher market conditions. On a quarter-to-quarter basis, the clothing segment recorded a loss in turnover and production, while textile’s turnover showed the slowest growth since the 1st quarter 2021. Export performances were also weaker in textiles, while clothing exports continued to increase at a steep rate. EU imports showed a similar trend, with a fall in textiles and a surge in clothing products. Compared to other indicators, the labour market remained at relatively healthy levels.

The post-pandemic economic recovery in Europe has faded as a result of the Russian invasion of Ukraine. Russia’s war on Ukraine and the disruptions in trade caused a rapid deterioration of the economic outlook. It adds to pre-existing inflationary pressures by strongly raising energy- and commodity prices, exacerbates imbalances in supply and demand, and weakens the purchasing power of households. The risk of persistent inflation and stagflation has risen. Although tougher market conditions are starting to impact the T&C business activity, the intensity of the downturn moderated in response to fewer supply constraints and improved expectations about the global economy.

The EU Business Confidence* indicator for the months ahead slightly deteriorated in the textile industry, resulting mainly from managers’ more pessimistic views on their production expectations. Business sentiment nevertheless saw a sharp improvement in the clothing sector, due to positive developments in manager’s appraisals of the order-book levels, production expectations and in their assessments of the adequacy stocks of finished products.

Source: EURATEX- European Apparel and Textile Confederation

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.