February 6, 2023

ACCOMMODATION TAX GUIDE IN TÜRKİYE

*This Guide is prepared taking into account the legislation in force at the time of publication by Revenue Administration.

Introduction

The rules governing the application of the accommodation tax are included in Article 34 of the Expenditure Taxes Law No. 6802, which was amended by Law No. 7194. The general communiqué on the application of the accommodation tax was published in the Official Gazette on December 14, 2022.

Accommodation tax came into effect on 1/1/2023.

In this Guide, there are explanations and examples on subjects such as the scope of accommodation tax, services subject to accommodation tax, taxable event, taxpayer, exemptions, tax base, rate and declaration.

1. What is the Subject of the Accommodation Tax?

The subject of the accommodation tax includes the overnight services provided in accommodation facilities such as hotels, motels, holiday villages, pensions, apart hotels, guesthouses, camping, chalets, highland houses and services offered within the accommodation facility (such as eating, drinking, activity, entertainment services and the use of pool, sports, thermal and similar areas) are included by being sold together with this service

The nationality or country of residence of the person benefiting from the service is not taken into account in the implementation of the accommodation tax.

2. Which Types of Accommodation Facilities Are Subject to the Tax?

There is no limitation in the application of the tax in terms of accommodation facilities.

Regardless of the type, class, quality of the accommodation facility, its descriptions and descriptions in the relevant legislation, and whether it has a tourism operation

certificate and/or business establishment/operation certificate according to the relevant legislation, the services provided in all facilities that offer accommodation are subject to accommodation tax.

Overnight services provided in the following facilities and all other services offered within the accommodation facility by being sold together with this service are subject to accommodation tax:

The following facilities included in the Regulation on the Qualifications of Tourism Facilities:

- Hotels, holiday resorts, boutique hotels, private accommodation facilities, motels, hostels, apart hotels,

- Wellness facilities and thermal facilities with accommodation facilities,

- Farmhouse, village house, highland house, chalet, campings, recreation areas for accommodation,

- Other facilities that also provide overnight services such as tourism complexes, holiday centers, entertainment centers, personnel training facilities, special facilities.

– Except for those allocated as lodging; Facilities such as guesthouses, guesthouses, resting facilities, camps, which are reserved for the accommodation of personnel in places under the disposal of the public or private sector, under any name and for a period of time,

– Practice hotels operated in accordance with the relevant legislation,

– All other facilities, other than those mentioned above, that offer overnight services, regardless of whether they have a tourism operation certificate and/or a business opening/operation certificate.

The overnight services provided by social service organizations to those in need of protection, care and assistance as defined in subparagraph (f) of the first paragraph of Article 3 of the Social Services Law, and the services provided in facilities such as stopover points where no overnight accommodation is offered, are not subject to the accommodation tax.

3. Is the accommodation tax applicable to tents and caravans?

Accommodation tax is calculated for overnight services that take place in the tent set up within the accommodation facility, in the facility or in the caravan where the place is allocated. Accommodation tax is not collected from tents or caravans that are not set up in any accommodation facility.

Whether the people staying in the camps meet their overnight needs with their own means or whether the overnight stay is made in units such as tents, tent-cars, caravans, motorhomes, bungalows, whether owned by the enterprise or not, does not affect the nature of the service as an overnight stay.

4. What is the Scope of the Overnight Service Provided in Accommodation Facilities?

In the accommodation tax application, overnight service refers to the daily accommodation, accommodation and accommodation services provided by allocating a room or place in the accommodation facilities.

The provision of the service begins with the room where the overnight service will be provided and the bed at the disposal of the person in places where more than one person can stay together.

For daily overnight stays, accommodation tax is also required if the person leaves the facility without completing the overnight stay.

For overnight services that are expected to cover more than one day but are not completed, the days when the service is actually provided are taken as basis.

Example: Person (A) entered the accommodation facility (B) for one day for overnight stay and settled in the room allocated to him/her. In the evening of the same day, s/he paid the overnight stay and left the facility. In this case, the accommodation tax is calculated even if the overnight stay is not completed.

Example: Person (C) entered the hotel (D) to stay for 7 nights. On the third day of the stay, s/he left the property by paying only the 3-day overnight service fee. In this case, the accommodation tax is calculated for the days the person stays at the property, regardless of the length of stay agreed with the customer at check-in.

5. What is the Scope of Other Services Offered with the Overnight Service?

Services such as food, beverage, activity, entertainment services and the use of areas such as pool, sports, thermal, etc., which are marketed/sold as a concept together with the overnight service and offered within the accommodation facility, are subject to accommodation tax even if they are separately shown in the accommodation invoice or an invoice is issued for these services.

The fact that the other services offered together with the overnight service are provided by the facility’s own facilities or by the facility partially or completely from outside the facility have no effect on the tax application.

Example: Even if the hostel operator (A) shows the breakfast service included in the bed + breakfast accommodation option separately on the accommodation invoice it has issued or even if it issues a separate invoice for this service, the said service offered on site by being marketed or sold together with the overnight service is subject to accommodation tax.

Daily services provided to those who do not stay in the accommodation facility (those who do not receive overnight service) are not subject to tax.

6. Is Accommodation Tax Taken from Services Offered Outside the Facility?

In concept sales, including services outside the facility (for example, transportation, transfer, excursion, guidance, entrance to museums and similar services), in case of issuing a separate invoice for the services provided outside the facility, by clearly indicating the nature and amount of each service, or showing the prices for these services separately on the invoice to be issued for the accommodation service, accommodation tax is not calculated over these services. In this case, the tax is only collected on accommodation services.

Example: In the sale of a balloon tour to be offered outside the facility by the private accommodation facility operator (F), together with a three-night all-inclusive stay at its facility in Cappadocia, if a separate invoice is issued for the balloon tour or if the cost of the balloon tour is shown separately on the accommodation invoice, accommodation tax is not calculated for the said service, which is used independently of the accommodation service and provided outside the facility.

7. Is Accommodation Tax Taken From Organization Services?

Circumcision ceremony, wedding, cocktail, meeting, congress, symposium and similar organization services provided in accommodation facilities are not covered by the accommodation tax.

In case the said organization services are provided in a way to include accommodation and if the nature and amount of the organization service is clearly indicated on the invoice issued or a separate invoice is issued for these services, accommodation tax is not calculated over these services. In this case, the tax is only collected on accommodation services.

Accommodation tax base cannot be lower than the equivalent price for the accommodation service in the sales made to include the services outside the facility and the service presentations are invoiced separately or shown separately on the same invoice.

8. What is the Taxable Event in Accommodation Tax?

The taxable event occurs with the provision of services that provided under the subject of the tax. The fact that some or all of the price is collected before or after the service is rendered, or not collected at all, has no effect on the taxable event.

For services sold by agencies or accommodation facilities before the accommodation date, the tax arises upon the provision of the service to the accommodation.

In case of issuing invoices or similar documents before the service is rendered, the taxable event does not occur.

9. Does a Taxable Event Occur in Free Accommodation?

The taxable event is deemed to have occurred in cases where the operators of the facility and their relatives or business personnel benefit from accommodation services free of charge, or if accommodation services are provided to other persons free of charge under the names of promotions, giveaways, gifts, promotions and similar.

In the accommodation facility, the overnight stay of the facility personnel in the places allocated for their own use is not covered by the tax.

10. Who is the Taxpayer of Accommodation Tax?

The taxpayer of the accommodation tax is those who provide the services that fall under the subject of the tax. Whether the property belongs to the operator or not, whether the facility is operated by the public or private sector, real or legal persons or organizations that do not have legal personality, has no effect on the liability.

The liability is established by the tax office to which the operator of the accommodation facility is affiliated in terms of VAT, and for those who do not have VAT liability, by the tax office of the place where the facility is located.

Taxpayers are those who actually operate the facility where accommodation services are provided.

11. How Is Liability Established?

Transactions about the establishment of tax liability of taxpayers with VAT liability are automatically carried out by the system as soon as they approve their accommodation tax returns electronically. It is possible for taxpayers to apply to the Tax Office Directorates to which they are affiliated in terms of VAT, and carry out their transactions regarding the establishment of tax liability.

Those who do not have VAT liability apply through the Interactive Tax Office with the “Accommodation Tax Declaration Obligation Opening Petition” in order to establish accommodation tax liability. If this way is not used, the taxpayer can apply to the Tax Office Directorates where the facility is located.

For all accommodation facilities within the jurisdiction of the same or different Tax Office Directorates/Financial Directorates within the borders of the same province of taxpayers who do not have VAT liability, upon request, it is possible for them to establish a single taxpayer by applying to the Tax Office Directorates deemed appropriate by the relevant Tax Office (Revenue Office in provinces where it is not present).

12. Which Services Are Exempted From Accommodation Tax?

- Services provided to students in dormitories, hostels and camps are exempt from accommodation tax.

- The services provided to the diplomatic representations and consulates of foreign states in Turkey and their members with diplomatic rights, and to international organizations and their members that are granted tax exemption pursuant to international agreements, are exempt from accommodation tax, provided that they are mutually exclusive.

In case of providing services subject to tax to non-students incidentally in student dormitories, hostels and camps, no exemption is applied for such sales.

13. What is the Base of Accommodation Tax?

The base of the accommodation tax is the sum of money and representable benefits, services and values provided in money, goods and other forms that are received or owed for these services in any way, excluding VAT, in return for the services included in the subject of the tax

VAT is not included in the accommodation tax base.

Various incomes related to the accommodation services offered, such as maturity difference, price difference, foreign exchange difference, interest, premium, and all kinds of benefits, services and values provided under similar names are also included in the assessment.

14. What is the Rate of Accommodation Tax?

The rate of accommodation tax is 2%.

15. Which exchange rate should be used as the foundation in the event that the price is determined in a foreign currency?

In case the price is calculated in foreign currency, the foreign currency is converted into Turkish currency at the foreign exchange buying rate of the Central Bank of the Republic of Turkey valid on the date of the taxable event. In the conversion of foreign currencies not announced in the Official Gazette by the Central Bank into Turkish currency, the current exchange rate on the date of occurrence of the taxable event is taken as basis.

16. How should the document be prepared in case the Accommodation Service is Sold to the Customer by the Agency Including the Accommodation Tax?

Provided that the accommodation service is sold to the customer by the agency, including accommodation tax, and this situation is proven and proven to the accommodation facility, the accommodation tax is shown on the invoice to be issued by the accommodation facility to the agency regarding the accommodation service.

Accommodation tax is not shown on the invoice issued by the agency to the customer.

17. How is Accommodation Tax Shown on Invoices and Similar Documents?

Accommodation tax is shown on invoices and similar documents issued by accommodation facilities. No deduction can be made from this tax under any name.

Even if an invoice or similar document is issued before the accommodation service is rendered, accommodation tax is not shown in this document.

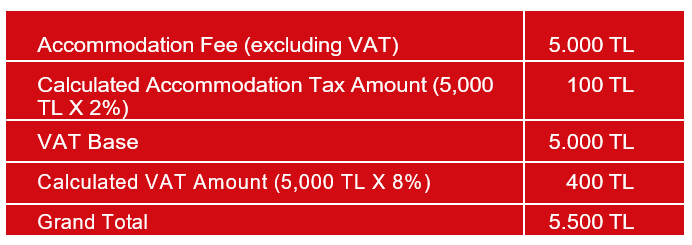

Example: The customer is invoiced as follows regarding the full board accommodation service offered by the hotel operator (G) for 5,000 Turkish Lira excluding VAT.

18. What is the Taxation Period for Accommodation Tax?

The taxation period is one-month periods of the calendar year in which the activity is carried out.

19. When is Accommodation Tax Declared and Paid?

Accommodation tax is declared to the tax office to which you are affiliated in terms of VAT until the evening of the 26th day of the month following the taxation period. For those who do not have VAT liability, the location of the facility is declared electronically to the tax office. The tax is paid within the filing period.

Accommodation taxpayers have to file a tax return for these periods, even if they do not have taxable transactions in a taxation period.

20. How to Fix/Change Declared Accommodation Tax?

The tax calculated excessively or unduly in the declaration must first be returned to the buyer/guest by the taxpayer. Following the correction of the related period declarations, the refund of the tax that is calculated and paid excessively or improperly can be requested within the framework of the procedures and principles stipulated in the General Communiqué of the Tax Procedure Law No. 429.

Source: Revenue Administration of Republic of Türkiye- Translated by Karen Audit – KarenAudit owns the rights to this translation, and any unlawful use is forbidden.

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.