31.08.2021

Almost everyone agrees that the engine of today’s dizzying speed of change is the internet. We observe that sharing the practice easily over different platforms beyond theoretical knowledge turns into new ideas and methods in people of all ages, educational institutions and companies, and accumulated knowledge becomes completely different in a short time with its multiplier effect.

People from different parts of the world interact in a virtual world without borders. We say virtual, but this word no longer meets exactly what we want to say. Because we can see, hear and even feel to a certain extent in this virtual world without borders.

Augmented reality applications, which were initially developed for the game world, are now used in countless areas and continue on their way without slowing down. After the arrow was released from the bow, it became difficult for the archer to predict to where the arrow would go. Entrepreneurs and investors are in competition with each other to quickly adapt useful ideas to their fields in order to be the first and to find themselves at the forefront of the competition and privileged place.

The flexibility of movement in the new virtual world has great opportunities for people of all ages, especially for the new generation. One of these is, of course, the possibility of freelancing without being tied to a business. In this way, people working in tens of thousands of fields such as software developers, designers, writers, content managers, education, editors, social media account management, advertising and marketing can work remotely without being dependent on a business or organization. It is now a fact that most people agree that this new way of working, which has undergone a great transformation and accepted worldwide from necessity due to pandemic conditions, will reach even greater volumes in the near future.

In this article, we will talk about some basic information about the taxation of software, which is one of the areas where remote work is common, in Turkey in terms of the real person (sole proprietorship) providing the service.

First of all, let us mention that real persons residing in Turkey and operating in the field of computer software must open tax liability within the scope of commercial activity. If people are performing these activities from home, they have to apply to the tax office to which their home addresses are linked, and file an income tax liability (Liable: person or organization liable to pay tax).

After the tax liability is opened in the tax office, they have to submit their monthly, quarterly and annual declarations to the affiliated tax offices, like other sole proprietorships engaged in commercial activities. Since there are subjects that require expertise, Independent Accountants and Certified Public Accountants fulfill their tax duties on behalf of the taxpayers.

If you are a young entrepreneur under the age of 29 (including software developers), your earnings up to 75.000 TL per year for 3 years, starting from the year you open your tax liability, will be exempt from income tax. (For details, you can review the 20th article of the Income Tax Law.)

The conditions you need to meet in order to benefit from this exemption, which is called the Earnings Exemption for Young Entrepreneurs, are summarized below.

1- Notification of starting work within the legal period.

2- Working actively in one’s own business or being directed and managed by the business itself.

3- In case the activity is carried out within the body of an ordinary partnership or a sole proprietorship, all of the partners must meet all the conditions as of the start date.

4- The fact that a business or professional activity that has been stopped or continues to operate (except when the activity is taken over by the spouse and children due to death) has not been taken over from the spouse or third-degree (including this degree) blood relatives or kinship by marriage.

5- Not being a shareholder in an existing business or professional activity afterwards.

(It is possible to access the support and conditions provided within the scope of the Young Entrepreneur Exemption from the Income Tax General Communiqué Serial No. 292 and the SSI Circular on the Young Entrepreneur Incentive Practice No. 2018/28.)

Moreover, with the article 89 of the Income Tax Law (ITL) titled other discounts, half of the income obtained from the software services provided to foreign customers to be used abroad is exempted from income tax.

To benefit from this exemption;

– With people who are not settled in Turkey,

– For those whose workplace, legal and business center is abroad

– For architecture, engineering, design, software, medical reporting, accounting bookkeeping, call center, product testing, certification, data storage, data processing, data analysis provided in Turkey and exclusively used abroad, 50% of the income obtained exclusively from these activities of businesses providing services to people who are not settled in Turkey is exempted from Income Tax.

– In order to benefit from this discount, an invoice or similar document must be issued on behalf of the customer abroad.

Accordingly, regardless of the age of the entrepreneur, 50% of the income earned by the person operating the software through the individual business s/he opened in his/her own name in Turkey from the activities included in the above scope will be exempt from income tax. There is no time limit for this exemption. As long as article 89 of the Income Tax Law remains in effect, the entrepreneur will be able to benefit from this exception.

For example;

The amount of payment made by a company in Germany to a software developer, Mr. Can, operating as an individual enterprise in Turkey to be used in its activities in Germany in 2021 is EUR 60 thousand in return for an invoice. (TL equivalent is assumed as 600 Thousand TL.)

In return for an income of 600 thousand TL, Mr. Can has a total of 200 thousand TL expenses in 2021, and his year-end earnings and taxable income are netted as 400 thousand TL. Mr. Can’s turnover of 600 thousand TL and his taxable income of 400 thousand TL after expenses are all within the scope of the business he made for a German company and benefited by this company abroad.

Accordingly, 50% of Mr. Can’s taxable income of 400 Thousand TL will be exempted from income tax within the scope of Article 89 of the Income Tax Law and the income tax to be paid will be as follows.

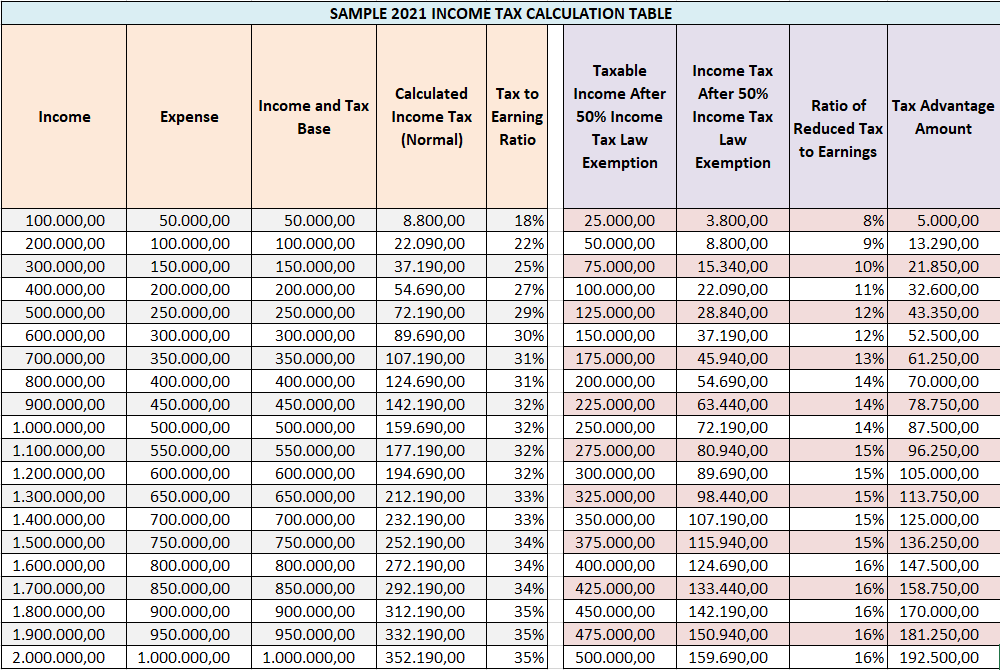

Income : 600.000 TL

Expense : 200.000 TL

Earning : 400.000 TL

Tax exemption : 200.000 TL (400.000 x 50%)

2021- Income Tax : 54.690 TL (The profit rate of the tax rate is about 13%)

If there was no 50% tax exemption, the income tax to be paid would have been 124,690 TL and the tax rate would have been approximately 31% to the income of 400 thousand TL.

In this case, the 50% income tax exemption applied to Mr. Can’s income had a benefit of 70 thousand TL. Although the rate of income tax exemption is 50%, the benefit it provides due to the progressive income tax tariff has been realized more.

While the ratio of the income tax paid to the earnings was 13% thanks to the income tax exemption, this rate would have been 31% without the exemption.

Below, the sample calculation table for the income tax to be paid without exemption and the income tax to be paid after 50% income tax exemption according to different earnings amounts in 2021 is shared.

The 50% earnings exemption also exists for companies. Tax exemption for companies is regulated in Article 10 of the Corporate Tax Law.

Furthermore, it should be noted that earnings from software activities carried out in technology regions in Turkey are exempt from income tax if certain conditions are met, and also that income and stamp tax exemption and SSI (Social Security Institution) employer premium supports are applied for the wages of the personnel working in the region, and we will discuss this issue in another article.

Ali KARAKUŞ

info@karenaudit.com

Karen Audit & Public Accountant Company

Istanbul

Source: Ali KARAKUŞ, CPA – Karen Audit & Public Accountant Company

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.