New data demonstrate how the additional US tariffs announced on April 2 have had a sizeable impact on global economic conditions, with exports weakening, inflationary pressures rising, and sentiment slumping.

These signals are derived from new tariff indicators added to the S&P Global PMI™ Comment Trackers, a dataset that harnesses the qualitative evidence provided by PMI survey contributors around the world. These trackers allow us to assess the direct impact of changes in global tariffs on businesses, by monitoring comments related to metrics such as exports, input prices, selling charges and business confidence.

Calculating the trackers

The tariff trackers form a new part of the broader S&P Global PMI™ Comment Trackers dataset, which is a collection of time series economic indicators derived from the qualitative information received from surveyed companies around the world, comprising in excess of 30,000 business executives and decision makers in over 40 countries. Alongside the standard responses to survey questions on metrics such as output, new orders, prices and employment, survey contributors are invited to give reasons as to why these variables have changed from the previous month.

Our panel comments tool tracks the frequency of words or phrases mentioned in these qualitative replies, in order to assess the impact of key economic drivers on business conditions. The themes span demand, supply chains, labour availability, material costs, uncertainty and more.

As the global economic landscape becomes increasingly impacted by evolving trade policy, largely through the introduction of new US import tariffs on its trade partners, we have added tariffs to our panel comments tool to give direct signals of its impact on key business variables in the manufacturing sector including new export orders, input costs, output prices and future activity expectations.

To better assess the size of the impact in relation to other periods of heightened trade policy in the sample time period, every index is calculated as a multiple of the average number of comments received in 2018 and 2019, during which tariffs were set during President Trump’s first term. This average is set equal to a value of 1.0, therefore an index reading greater than 1.0 suggests that the directional impact of tariffs on the specific measure is larger than the average recorded in those years. Indices are smoothed using a three-month rolling average.

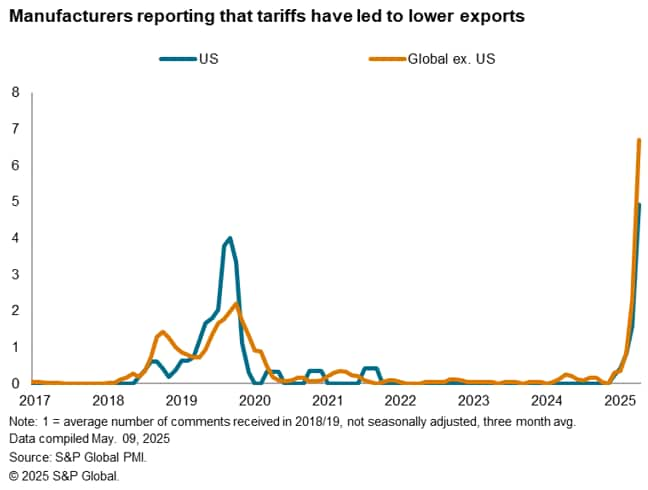

Tariffs greatly contribute to slump in exports

Tariff trackers are very useful in assessing the impact on the global and regional trade landscape, something which our survey panellists indicated was greatly disrupted following the tariff announcements on April 2. The global PMIs showed goods trade contracting over the month at the sharpest pace since August 2023, with tariffs frequently mentioned as a key, or contributing, factor.

Furthermore, this downturn was not limited to the US’s trade partners, with several domestic manufacturers also reporting a decline in new export orders. Reciprocal measures from mainland China and Canada had a partial effect on driving exports down, but anecdotal evidence also highlighted that increased uncertainty had led foreign clients to withhold spending. As such, both our US and Global-excluding-US trackers moved sharply higher in April, with the number of comments received multiples higher than seen during 2018/19.

Additional regional splits in the dataset allow us to directly monitor the hit to export conditions in Europe and Asia. European manufacturers, particularly those in the eurozone, reported an especially sharp decrease in export sales due to tariffs in April, with this tracker rising to a record high. Asian firms likewise signalled a considerable hit to exports as customers held back spending.

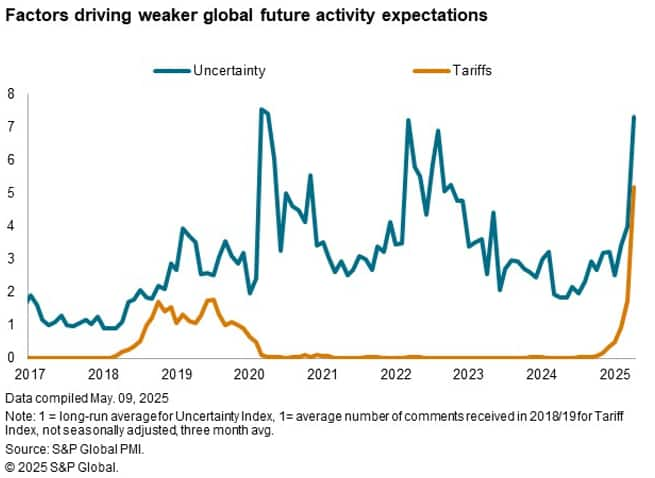

Sentiment falls to two-and-a-half year low as business uncertainty rises

As highlighted in our April Global PMI round-up, future output expectations among global manufacturers was another indicator that dropped sharply as a result of concerns over the projected impact of tariffs on future business conditions. The Tariff Comment Trackers show that this related pessimism was indeed sizeable, with the number of survey comments mentioning “tariffs” rising sharply from March to a record high.

Notably, survey comments on tariffs were often paired with comments of “uncertainty”, as firms generally remain unclear about the direction and size of tariffs and the resulting economic impact going forward. Our Uncertainty Comment Tracker, which is a part of our standard Comment Tracker dataset, signals that heightened uncertainty drove down manufacturing expectations by one the greatest degrees on record, in fact nearly matching the levels seen during the opening months of the COVID-19 pandemic.

Announcements in May (at the time of writing), including an agreed reduction in bilateral tariffs between the US and mainland China and a limited trade deal between the US and the UK, suggest that business uncertainty and “tariff pessimism” are likely to ease. That said, the continued imposition of a number of bilateral tariffs, as well as the possibility of these rising after the current 90-day pause announced on April 9, indicate a still high degree of caution going forward.

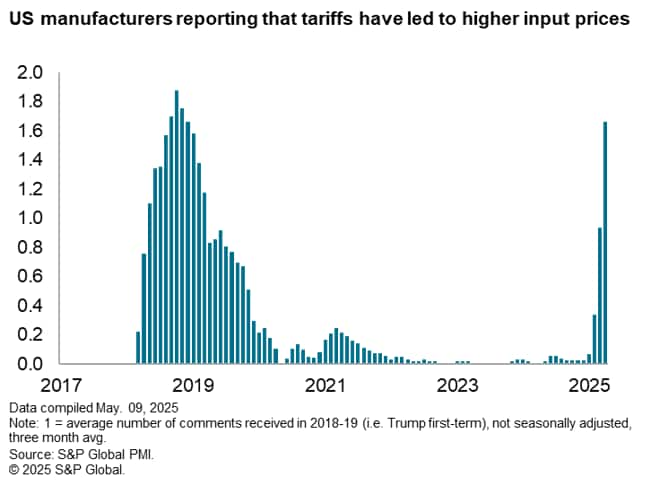

Price pressures heighten in the US and globally

The final area that our new tariff trackers focus on is our survey price metrics, which allow us to monitor the direct inflation risks from implemented tariffs. As the Global PMI surveys ask businesses about both input costs and output (selling) prices, the tariff trackers provide insight into not only the quantitative impact on firms’ expenses, but also to what degree this is being passed on to customers through higher selling charges.

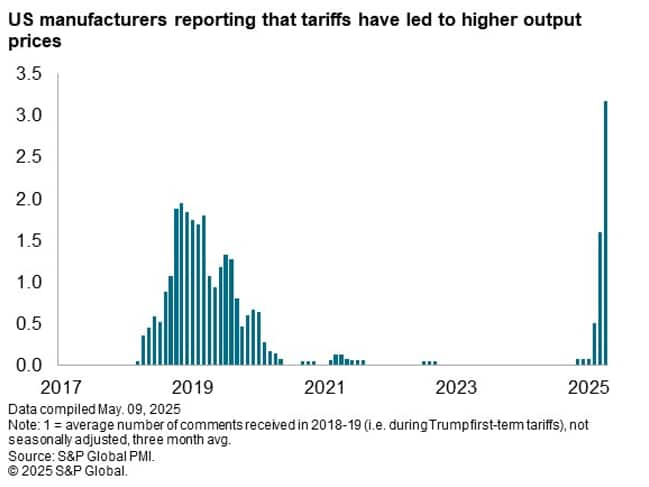

April data pointed to a sizeable jump in the number of survey panellists mentioning tariffs as a key driver of inflationary pressures globally. Focusing on the US, the data indicated that, on a smoothed three-month basis, the tariff impact on input costs rose to 1.7 times the average observed in 2018/19 in the three months to April. In fact, nearly half of all comments related to an increase in costs over the latest survey period explicitly mentioned tariffs.

US manufacturers also reported raising their output prices in response to tariffs. In fact, comments on this survey question were the highest on record and twice the level observed in the previous month. As such, US manufacturing output price inflation as measured by the PMIs was the steepest recorded since February 2023, suggesting that producers are generally unwilling to absorb these tariffs in the hope that costs will abate.

Outside of the US, the inflationary impact of tariffs was also notable. There were frequent mentions of higher costs from manufacturers in Canada and mainland China as increased import tariffs on US goods took effect. However, there were also many reports of tariff-related impacts on firms in other countries, who reported that the indirect effects of higher supplier fees and disturbed supply chain logistics had added to business expenses. Our Tariff Trackers signalled that the impact in Europe and Asia has already been much greater than seen during the previous round of trade protectionism eight years ago.

Source: S&P GLOBAL – by David Owen

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.