17.06.2021

1.Loss Offsetting of Turkish Companies

The losses arising from the commercial activities of the Corporations can be deducted from the profits arising in the following periods according to the explanations below.

1.1. Losses of previous periods

Losses in the returns of previous years can be deducted from the corporate income, provided that the amounts for each year are shown separately in the corporate tax return and are not transferred for more than 5 years.

If the loss incurred by the taxpayers within an accounting period cannot be offset with the profits to be generated in the following 5 accounting periods, offsetting will not be possible.

1.2. Loss offsetting in case of transfer and spin-off

In cases of transfer or full spin-off, the Corporations that have taken over the assets have the opportunity to set off the losses of the Corporations that have been taken over or split up within the limits specified below.

Accordingly, the transferee Corporations will be able to deduct the following from their earnings, in addition to the losses incurred within their own structure:

- Losses not exceeding the equity amount of the Corporations taken over in case of transfer as of the transfer date

- Losses not exceeding the equity capital of the Corporation split up as a result of the full spin-off transaction

In case of transfer and spin-off, the transferred loss amounts are limited to the equity capital of the acquired or Corporation split up. In a full spin-off transaction, the portion of the loss not exceeding the transferred amount of the equity capital of the said Corporation and proportional to the acquired value can be deducted from the losses of the division.

1.2.1. Equity amount

Equity is the capital of the Corporation determined as of the date of transfer or spin-off in accordance with the Tax Procedure Law. Pursuant to Article 192 of the Tax Procedure Law, the difference between total assets and debts constitutes equity. The explanations made in the section (12.1.5) of this Communiqué will be taken into account in the equity calculation.

In case the equity capital of the transferred or Corporation split up is zero or negative, it is not possible to deduct the losses of these Corporations.

1.2.2. Conditions for loss offsetting in case of transfer and spin-off

In order for loss offsetting to be made in case of transfer and spin-off, the following are required:

- The corporate tax returns for the last 5 years of the acquired or Corporations split up must be submitted within the legal time limit.

- The Corporation that will make a loss offsetting as a result of the transfer or spin-off must continue the same activity for at least 5 years from the accounting period in which the transfer or spin-off occurred.

With the article 9 of the Corporate Tax Law, the condition of “continuation of the same activity” has been introduced in order to be able to deduct losses in transfer and spin-off transactions. This condition is narrower than the condition of “operating in the same sector” in the repeating article 14 of the abolished Law No. 5422 and the transferee Corporations are obliged to continue their activities for at least 5 years from the date of the transfer or spin-off occurred.

With the acquisition of corporations that cannot be brought into the economy for tax avoidance purposes by transfer, division or loss offsetting is not possible if the transfer and spin-off transaction is made due to non-economic reasons such as partial suspension or termination of the activities of the Corporations transferred or split up within a period of 5 years by making incidental.

Since the possibility of loss offsetting will be eliminated in case of violation of the conditions, the necessary correction will be made and tax loss will be deemed to have arisen for the taxes that are not accrued on time due to the undue loss offsetting.

1.2.3. In case of transfer and spin-off, the order of loss offsetting and the amount of loss that cannot be offset

Transferred losses can be offset within a period of five years from the time they occurred in the Corporation transferred or split up.

The losses that can be offset in case of transfer and spin-off can be determined freely by the taxpayers, provided that the accounting period they belong to is separately stated in the annex of the declarations of the transferee Corporations. Loss amounts exceeding the equity limit will be canceled.

1.3. Offsetting of Foreign Loss

In the event that a loss arises from the foreign activities of the Corporations, it is possible to deduct the foreign losses from the corporate income within the conditions specified in the article. However, there is no deduction facility for foreign losses related to activities whose earnings are exempt from corporate tax in Turkey.

Accordingly, since the earnings from overseas construction and repair works are exempted from corporate tax in Turkey, according to subparagraph (h) of the first paragraph of Article 5 of the Law, in case of loss from these activities, these losses cannot be deducted from the gains from other activities.

1.3.1. Authentication of Foreign Loss

In order for Corporations to deduct their losses arising from their activities abroad from the profits they declare in Turkey, they must have the tax bases (including damages) declared in accordance with the tax laws of the country in which they operate, examined and included in the report every year by the Corporations that have audit authority in accordance with the legislation of that country, and submit a translated copy of this report together with the original to the relevant tax office in Turkey. In addition, the tax declarations, balance sheet and income statement to be included in the annex of the report prepared by the said audit Corporations must be approved by the competent authorities in the foreign country.

If there is no auditing authority in the foreign country where the activity is carried out, a copy of each year’s tax return, its annexed balance sheet and income statement, to be obtained or approved by the competent authorities of the foreign country, must be approved by the Turkish embassies or consulates in the locality, if there is no such representative of the country protecting Turkish interests, and the original and a translated copy must be submitted to the relevant tax office.

1.3.2. Obligation to have an audit

Corporations that want to deduct their foreign losses from their declared earnings in Turkey are required to certify the results of their activities abroad in accordance with the above principles.

In order for taxpayers to deduct their foreign losses, they must have submitted their reports for the last five years, prepared according to the principles specified in the article, to the relevant tax office.

For example, if a taxpayer Corporation that made a profit in the 2002, 2003, 2004 and 2005 accounting periods and made a loss in the 2006 accounting period, submitted the reports of the last five years to the tax office to which it is affiliated in the relevant years, it is possible to deduct foreign losses for the 2006 accounting period, excluding those related to earnings exempted from corporate tax in Turkey.

However, if the taxpayers have not submitted the said reports to the relevant tax office, it will be sufficient to submit the reports regarding these periods in the relevant period in which the loss will be deducted.

1.3.3. Loss offsetting abroad

If the foreign loss subject to deduction in Turkey is deducted or written off in the relevant country, the foreign income to be included in the declaration in Turkey is the amount before deduction or expense.

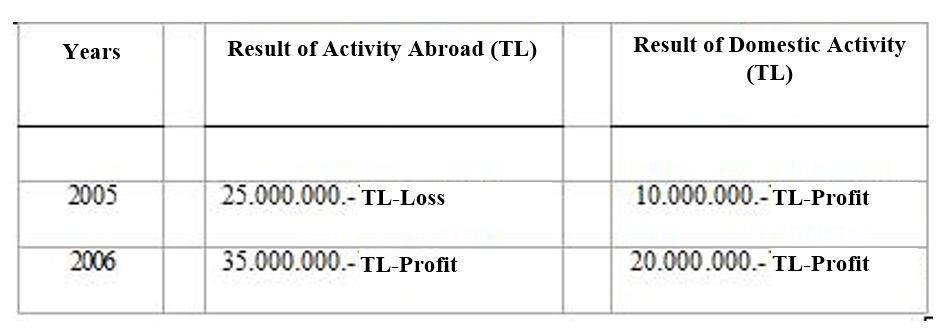

For example: The results of the (A) Corporation’s domestic and international activities in 2005 and 2006 are as follows:

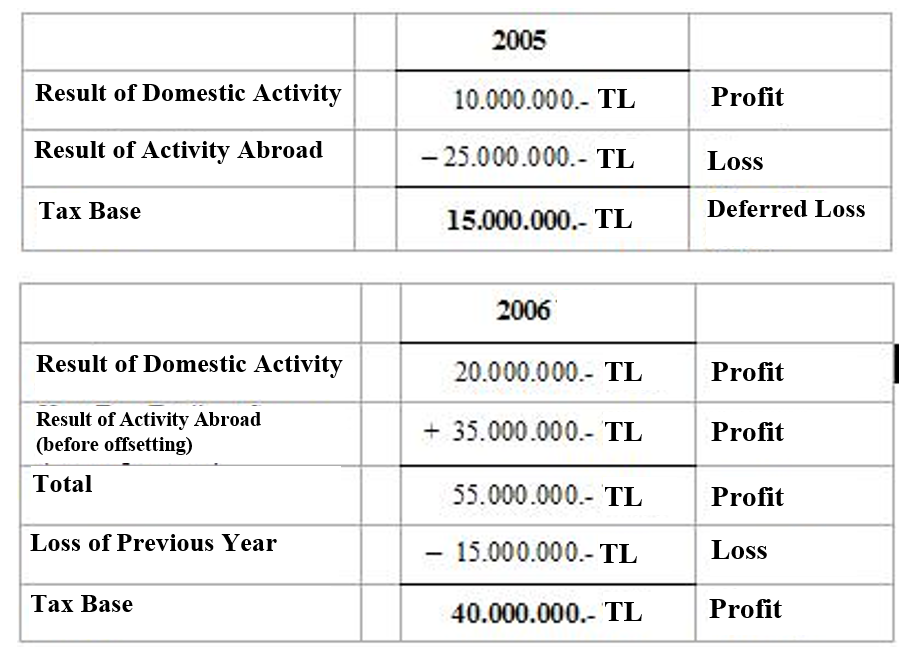

In the declaration submitted in the foreign country regarding the year 2006, an equivalent of 10.000.000.- TL has been declared by deducting 25.000.000.- TL loss from the 35.000.000.-TL profit. The tax base to be declared by the Corporation in its annual declaration in Turkey regarding the years 2005 and 2006 will be calculated as follows.

1.3.4. Result of Previous Year’s Activity

Since the provision regarding the deduction of foreign losses in subparagraph (b) of the first paragraph of Article 9 of the Corporate Tax Law No. 5520 is also included in the abolished Corporate Tax Law No. 5422, it is obligatory for corporations to certify their foreign activity losses for previous years within the framework of the explanations given above.

1.3.5. The time of transferring the results of the activity to the general result accounts

The explanations made in the section (5.9) of the Communiqué on the timing of the transfer of the results of operations abroad to the general results accounts in Turkey will be valid.

Profits arising from foreign operations must be transferred to the general results accounts in Turkey in the same currency as the losses.

Source: Revenue Administration of Republic of Turkey – Translated by Karen Audit – The rights of this translation belong to KarenAudit and unauthorized use is prohibited.

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.