21.06.2021

1- Controlled Foreign Corporation Earnings

According to Article 7 of the Corporate Tax Law, it is accepted that taxpayers who invest in foreign subsidiaries under certain conditions are paid dividends in terms of tax applications, even if no actual dividends are distributed from these subsidiaries, and in this way, it is ensured that the earnings of these subsidiaries are subject to corporate tax in Turkey.

The concept of controlled foreign corporation refers to foreign subsidiaries that fully taxpayer real persons and corporations directly or indirectly control separately or together by owning at least 50% of their capital, dividends or voting rights.

With the expressions “directly or indirectly” and “separately or together” mentioned in the article, it is prevented that the partnership shares of the foreign subsidiary are shared between group companies or real persons, and going out of the scope is below the control rate specified in the article.

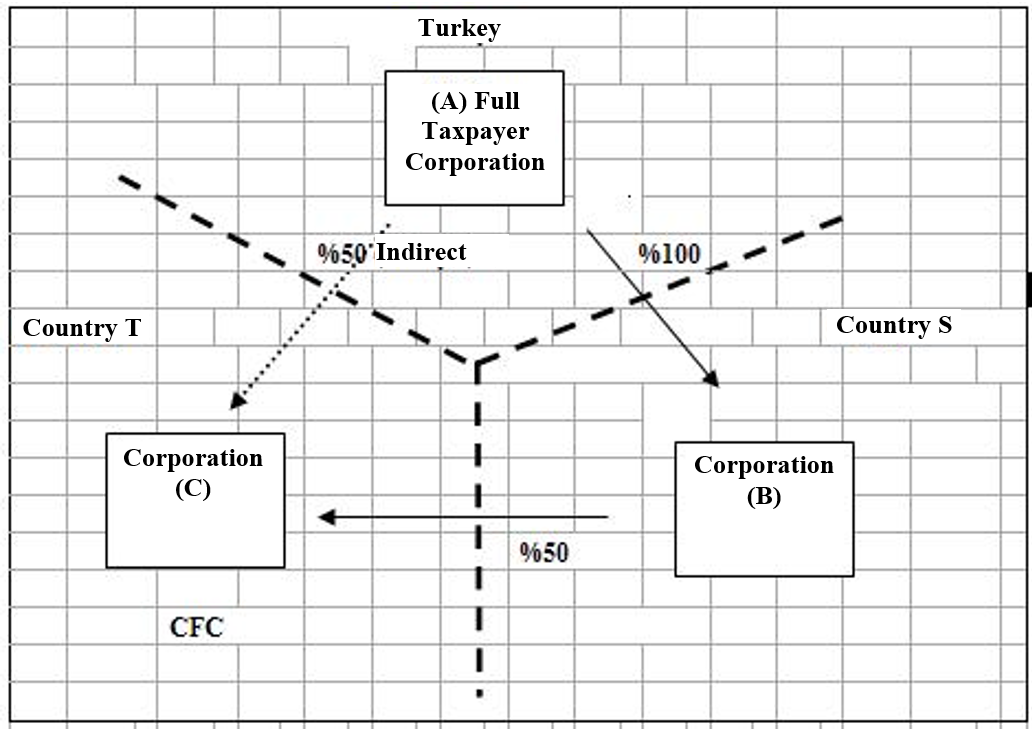

Example 1: Corporation (A), which is a full taxpayer in Turkey, participates 100% in the capital of Corporation (B) established in Country (S). 50% shares of Corporation (C) established in country (T) belong to Corporation (B). In this case, since Corporation (A) participates in Corporation (C) indirectly (100% x 50%=) 50%, Corporation (C) will be considered as a controlled foreign corporation if other conditions are also met.

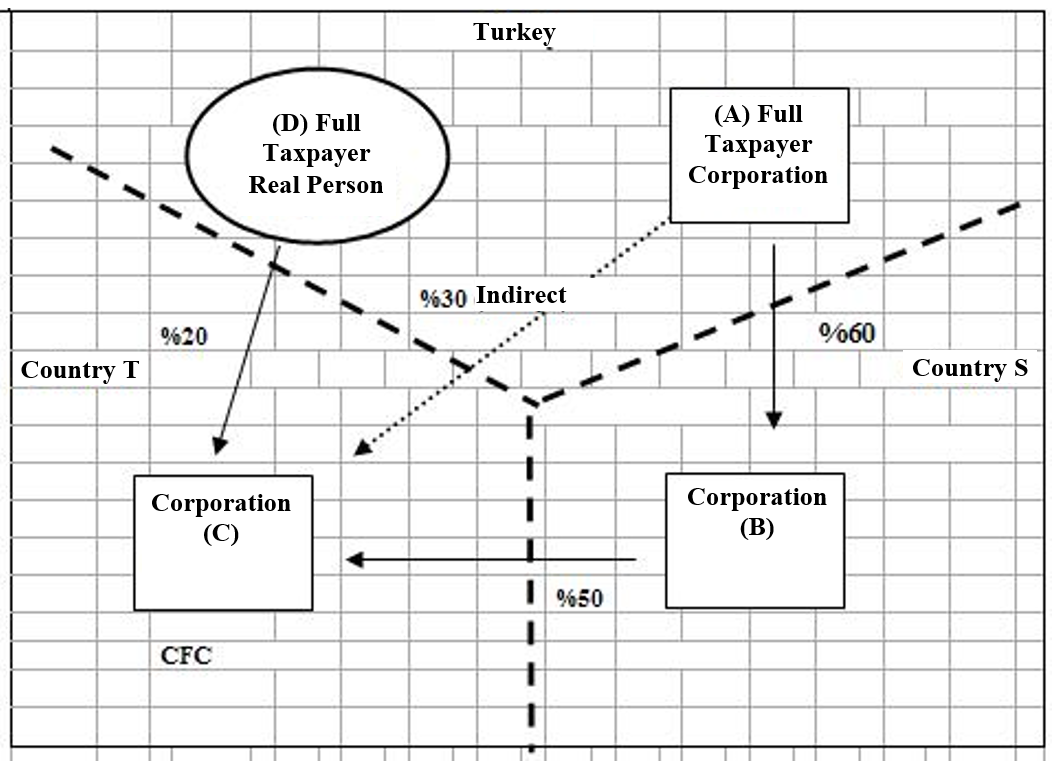

Example 2: Corporation (A), which is a full taxpayer in Turkey, participates at the rate of 60% in the capital of Corporation (B) established in country (S). Corporation (C) established in the country (T) owns 50% of the shares of Corporation (B). Corporation (C)’s 20% share belongs to the real person (D), who is also a full taxpayer in Turkey. In this case, Corporation (A) participates in Corporation (C) indirectly (60% x 50%) by 30%. On the other hand, considering that the natural person (D) also directly participates in the Corporation (C) at the rate of 20%, since the total participation rate of the Corporation (A) and the real person (D) in the Corporation (C) is 50%, so Corporation (C) will be considered as a controlled foreign institution if other conditions are also met.

On the other hand, whether a real person (D) is related to the Corporation (A), which is a full taxpayer in Turkey, has no importance in the practice of the controlled foreign corporation.

When determining the controlled foreign corporation, if the indirect subsidiary relationship has several stages, partnership relations will be taken into account until the last indirect subsidiary.

1.1. Controlled foreign corporation

In order for a corporation abroad to be considered a controlled foreign corporation, at least 50% of the capital, dividend or voting right of this institution must belong directly or indirectly, separately or jointly, to fully taxpayer real persons and corporations.

In determining whether the foreign subsidiary is a controlled foreign institution, the highest control ratio held at any time during the relevant accounting period will be taken into account.

If the entire share (capital, dividend or voting right) of the foreign subsidiary is disposed of without collusion at any date before the end of the accounting period of the foreign subsidiary, the provisions of this article shall not apply to the relevant foreign subsidiary.

1.2. Conditions regarding the corporate income of a foreign subsidiary to be subject to corporate tax in Turkey

The following conditions must be met together in order for the foreign subsidiaries that the aforementioned control ratio is achieved to be accepted as a “controlled foreign corporation” in the Corporate Tax Law application and therefore the corporate earnings of the controlled foreign subsidiaries to be subject to corporate tax in Turkey whether they are distributed or not.

1.2.1. 25% or more of the total gross revenue of the foreign subsidiary in the relevant year consists of passive income

25% or more of the total gross revenue of the foreign subsidiary in the relevant year must consist of passive income.

Passive incomes consist of income such as interest, profit share, rent, license fee, security sales income, excluding income from commercial, agricultural or self-employment activities carried out by capital, organization and employee employment proportional to the activity of the foreign subsidiary.

Income obtained from commercial, agricultural or self-employment activities, which are not proportional to the activities of the foreign subsidiary, through capital, organization and employment of personnel will also be considered passive income.

For example, let the composition of the gross revenue of the foreign subsidiary, which is a total of 100 units, be as follows;

| – Commercial income obtained through capital, organization and employee employment proportional to its activity……………………………… ……….. | 30 units |

| – Dividend ……………………………………….. …………………………. | 10 units |

| – Interest ………………………………………….. ……………………………………… | 50 units |

| – Securities’ trading income ………………………………….. | 10 units |

Accordingly, in order that the ratio of passive incomes (Dividend + interest + securities trading income) to total gross income (70/100=) is 70%, the condition specified for the controlled foreign corporation will be met.

In determining the nature of the passive income of the controlled foreign corporation, since the passive income characteristic of the dividends to be obtained by the said corporation from its subsidiaries will not change, it is of no importance that the subsidiaries of the controlled foreign corporation deal with active commercial activities.

1.2.2. Tax burden of foreign subsidiary

The corporate income of the subsidiary established abroad must be less than 10% of the total tax burden similar to income and corporate tax.

The tax burden will be determined according to the definition in subparagraph (b) of the first paragraph of Article 5 of the Corporate Tax Law. Therefore, the explanations made in the section (5.2.1.5) of the Communiqué regarding the tax burden will be considered.

1.2.3. Minimum gross revenue amount of foreign subsidiary

In order for the subsidiary abroad to be considered as a “controlled foreign corporation” in the application of the Corporate Tax Law, the gross revenue amount in the relevant year must be above 100,000.- TL equivalent in foreign currency. Subsidiaries of which total gross revenue in the relevant year is below this amount will not be considered as a controlled foreign corporation, even if all other conditions are met.

The foreign exchange buying rate announced by the Central Bank of the Republic of Turkey, which is valid on the last day of the accounting period of the relevant subsidiary, shall be taken as the basis for determining the TL equivalent of the revenue of the foreign subsidiary.

1.3. Controlled foreign corporation income to be included in the corporate tax base of full taxpayer corporations

The taxable income of controlled foreign corporations within the scope of this article will be corporate earnings before tax, after deducting expenses including loss deduction, before deductions.

In case the controlled foreign corporation does not have a distributable profit due to previous year losses, it will not be possible to mention taxable income in Turkey.

In the calculation of the income deemed to have been obtained from the foreign subsidiary, the shareholding rate of the foreign subsidiary at the end of the relevant accounting period (capital, dividend or voting right rate) will be taken into account.

In case the profit of the controlled foreign corporation is added to the capital, the said profit will be taxed in accordance with the provisions of the mentioned article.

In the event that full taxpayer corporations and real persons with full liability are also shareholders of the foreign corporation, the shares and participation shares held by the real persons will be taken into account in determining whether the foreign corporation is a controlled foreign corporation or not. In addition, the earnings to be obtained by the said real persons over the controlled foreign corporation will not be evaluated within the scope of this article, only the income obtained by the resident corporation will be subject to corporate tax within the scope of this article.

If the conditions of the controlled foreign corporation are fulfilled, the profit obtained by the subsidiary established abroad will be included in the corporate tax bases of the full taxpayer companies (and temporary tax bases as of the provisional tax periods) in proportion to their shares as of the accounting period of the said subsidiary’s accounting period. If there is an accounting period exceeding twelve months in the country where the controlled foreign corporation is located, the accounting period of the foreign company will be considered as the calendar year in determining the date of earning the profit.

On the other hand, it is not possible for the losses of the controlled foreign corporation to be taken into account in the determination of the earnings of the full taxpayer corporations participating in the said corporation.

Example 1:

The shareholding structure of the Company (CFC) abroad as of 20/5/2007 is as follows:

Shareholder Shareholder share

Full taxpayer real person (A) ……………………………… 40%

Full taxpayer corporation (B) ……………………………… 25%

Limited taxpayer real person (C) …………………………. 35%

The aforementioned company uses the accounting period of July 1 – June 30 in the country in which it is located. As of the end of the accounting period, the company’s corporate income is $200,000 and the corporate tax paid in the country it is based on is $10,000. The entire gross income of the company consists of passive income.

As of June 30, 2007, the full taxpayer corporation (B) has 5% of the shares of the aforementioned (CFC) Company in its assets.

Accordingly, 40% shareholder share held by full taxpayer real person (A) and 25% shareholder share of full taxpayer corporation (B) will be evaluated together as to whether the (CFC) Company is a controlled foreign corporation, and since the total participation rate of the fully taxpayer real person (A) and the full taxpayer corporation (B) to (CFC) company is 65% as of 20/5/2007, the (CFC) Company must be considered as a controlled foreign corporation for the 1/7/2006-30/6/2007 accounting period.

As of 30/6/2007, when the accounting period to which (CFC) Company is subject is closed, since the full taxpayer corporation (B) has 5% of its shares in its assets, as of this date, 5% of the company’s earnings will be deemed to have been earned by the full taxpayer corporation (B), whether it is distributed or not.

10,000 USD (200,000 x 5% =) calculated within this ratio will be considered as the profit share obtained by the full taxpayer corporation (B) as of 30/6/2007, and it will be included in the tax base of the second provisional taxation period. The tax [$500 (10,000 x 5% =) paid in the country where the foreign subsidiary operates] corresponding to the said income can be deducted from the corporate tax calculated in Turkey within the framework of the provisions in Article 33 of the Corporate Tax Law.

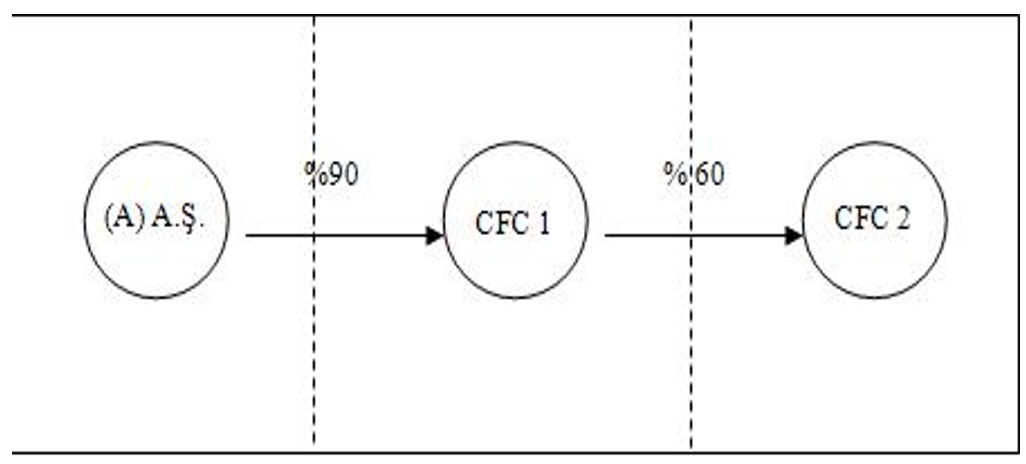

The earnings of the controlled foreign corporations, in which the full taxpayer corporations participate indirectly, will also be determined as the earnings of the foreign corporations in which they directly participate. According to the example, both companies, in which (A) A.Ş. participates, will be deemed to be controlled foreign corporations and the profits of both companies will be subject to tax in Turkey if the other conditions are met. After the profits of both companies are taxed in Turkey, in case of a profit distribution between the companies (For example, if CFC 2 distributes profits to CFC 1), the previously taxed CFC 2 profits will be taxed again in Turkey as CFC 1 profit will not be the matter.

1.4. Offsetting of taxes paid by the subsidiary abroad

According to Article 33 of the Corporate Tax Law, taxes such as income and corporate tax paid in the country where the foreign subsidiary is located can be deducted from the corporate tax calculated over the profit of the controlled foreign corporation to be taxed in Turkey.

However, it is not possible to deduct taxes, such as income and corporate tax that the controlled foreign corporation has paid in countries other than the country in which it is located, from the corporate tax calculated over the income of the said corporation to be taxed in Turkey.

For instance, the earnings of (CFC) Company established in Country (A) are taxed as profits of foreign corporations controlled in Turkey and the aforementioned company does not have any income other than dividend income. A tax deduction of 10% was made on the profit share of $100,000 obtained from Company (Y) in Malta, which is a subsidiary of the said (CFC) Company, and $90,000 was transferred to the (CFC) Company. (CFC) Company has paid 5% corporate tax in (A) country on this income.

Accordingly, the income of the (CFC) Company to be included in the corporate income and taxed in Turkey must be considered as $90.000, and the tax paid abroad to be deducted from the corporate tax calculated on this income must be considered as $4.500.

1.5. Taxation if the subsidiary distributes dividends

If the profits of the foreign subsidiary taxed in Turkey within the scope of the controlled foreign corporate income, are subsequently distributed by the foreign corporation, the part of the profit shares previously taxed in Turkey will not be taxed separately.

However, in the following years, if more dividends are distributed than the taxable earnings of the controlled foreign corporation in Turkey, the excess amount will be subject to corporate tax.

1.6. Controlled foreign corporation’s position against double taxation treaties

Double taxation avoidance agreements in force do not limit their right to tax their own residents according to the provisions of “Controlled foreign corporate income” in Article 7 of Turkey’s Corporate Tax Law. In other words, whether or not a dividend is distributed to a resident corporation in Turkey by another state resident corporation, the provisions of the Corporate Tax Law “Controlled foreign corporate income” will be applied.

However, in cases where the income taxed in Turkey as the profit of a foreign corporation controlled by a corporation residing in another state is distributed to a corporation residing in Turkey as a dividend, the provisions regarding the taxation of “dividends” and “avoidance of double taxation” in the Agreements will be applied normally.

In case a tax is made on the dividends distributed by the source country and these dividends are not exempted from corporate tax in Turkey, the profit share must be added to the corporate income in the year it is earned, and the corporate tax must be calculated over it, and the taxes paid in the other country related to this profit share must be deducted in accordance with the provisions of the agreement and the Corporate Tax Law on the deduction of the taxes paid abroad. If there is a residual amount after this deduction, the part of the corporate tax that is calculated and paid over the profits that was previously taxed as foreign corporate income, which is attributed to the said profit share, must also be deducted from the remaining amount. Provided that the dividend has been brought to Turkey, the part that cannot be deducted, can be returned.

In case the provisions of the relevant agreement stipulate that the said dividend distributed be exempted in Turkey, in the period when the dividend is distributed and brought to Turkey, the portion corresponding to the distributed profit share amount can be refunded from the corporate tax calculated and paid on the income taxed within the framework of the provisions on foreign corporate income that was previously controlled.

1.7. Enforcement in the controlled foreign corporation income

Article 7 of the Corporate Tax Law regarding the controlled foreign corporate income has entered into force on the date of its publication, to be applied to the earnings obtained as of 1/1/2006 and to be effective from this date. Therefore, the corporate earnings of the controlled foreign corporations for the accounting periods ending as of 1/1/2006 must be included in the earnings of the corporate taxpayers who directly or indirectly participate in the aforementioned corporations in proportion to their shares.

On the other hand, if the previous year’s profits for the accounting periods before 1/1/2006 of the corporations in which the controlled foreign corporation participates are distributed to the controlled foreign corporation after this date, since the profit will be earned as of the date of the profit distribution, the said profits must be taken into account in the calculation of the controlled foreign corporate income.

Source: Revenue Administration of Republic of Turkey – Translated by Karen Audit – The rights of this translation belong to KarenAudit and unauthorized use is prohibited.

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.